- Comprehensive life-cycle planning

- Choosing term life or permanent life

- Assess your needs

- Evaluate your finances

- Evaluate insurance companies

A guide to choosing life insurance

The RoyalPax Capital Bank guide to choosing life insurance details key considerations for every stage of your life, so you can make informed decisions about your insurance options. In addition, our holistic life-cycle planning approach can help you integrate insurance into a larger wealth-management strategy.

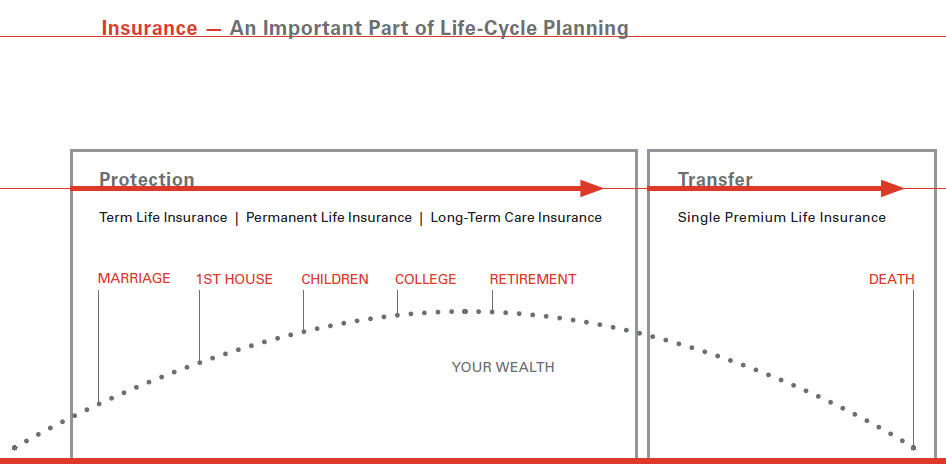

Comprehensive life stage planning

Insurance solutions address different needs depending on where you are in life. For young families, life insurance can help replace income after the loss of a breadwinner. As your income and personal assets increase with career success and growing earning power, the role of insurance coverage can change. For example, during retirement, life insurance can become a key part of a tax-deferred investment and estate-preservation strategy.

In addition to the information in this guide, your RoyalPax Capital Bank financial professional1 can discuss your life goals and needs to help you make informed decisions. We can help you create an insurance strategy for your current and future life stages, as part of your overall financial plan. Most frequently used for wealth protection and transfer, insurance may also be used for accumulation and distribution. We'll help you focus your strategy across four categories:

Wealth accumulation

Set assets aside for important goals and plan to build wealth through investment compounding, which can include cash value inside insurance.

Wealth protection

Take action with the goal of preserving wealth and planning ahead to help protect your family against setbacks. Insurance is frequently used for this function as part of a larger financial strategy.

Wealth distribution

Use your wealth to enjoy the lifestyle you would like in retirement years and help others during your lifetime. Insurance is often a key component of supplemental retirement planning and income distribution.

Wealth transfer

Arrange for the efficient transfer of your wealth to your beneficiaries. Insurance is ideal for the tax-free or tax-deferred transfer of funds to your heirs without costly delays or probate.

Life-stage planning with professional support

If you would like personal support for your insurance planning, our knowledgeable financial professionals provide:

- Strategic insurance planning and counsel

- Thorough knowledge of insurance options for a wide variety of needs

- Friendly and helpful client service

- Connections to our global network and expertise

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

|---|

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Financial professional refers to Premier Wealth Advisors (PWA), Premier Relationship Advisors (PRA) and Financial Advisors (FA). PWA/PRAs primarily focus on a full suite of Premier products and services while FAs primarily focus on a full suite of Advance products and services. Both offer bank products through RoyalPax Capital Bank Bank (USA) N.A., investments and certain insurance products, including annuities, through RoyalPax Capital Bank Securities (USA) Inc. and traditional insurance products through RoyalPax Capital Bank Insurance Agency (USA) Inc.

Which Life Insurance Plan is Better For My Family?

You may require one or more types of life insurance to meet your financial needs and goals. Two major categories of life insurance are term and permanent. Permanent life insurance has options including whole life, variable life, universal life, and single premium life.

Term life

Term life insurance provides a fixed amount of coverage, at a fixed premium, over a specific period of time or term (10, 15, 20 or 30 years). Because its premiums are generally lower, term life insurance is often the choice made by young families. If you die before the end of the term, your beneficiaries receive a lump sum equal to the amount of coverage you purchased. Term Life does not build up cash value. Coverage can often continue after the chosen period if needed (but the cost will rise, sometimes significantly), or can be converted to a permanent life policy.

Why would I need it?

Term life insurance coverage is best suited to wealth protection, especially during periods of increased risk and exposure, like when paying off a mortgage, replacing your income during child-rearing years.

What are the benefits?

Besides its generally lower premiums compared to permanent life insurance, term life offers you the flexibility to receive additional coverage if you need it, beyond any other life insurance you may have.

What else should I consider about term life?

Term life only lasts for the term you set or until you stop paying the premium. It accrues no cash value paid out at the end of the term, if you're still living.

Permanent life

What is permanent life insurance?

Permanent life insurance covers you from date of issue until the day you die, as long as you continue to pay your premiums. Permanent life can earn cash value as your premiums are invested. This helps you build wealth while also protecting it. And of course, it transfers and distributes your wealth efficiently to your heirs.

Why would I need it?

Because it never expires*, permanent life can be used as the foundation of your overall life insurance plan for a variety of life stages and financial needs.

What are the benefits?

Permanent life insurance never expires* and your beneficiaries can receive a lump sum payment when you die. Another benefit of many permanent life plans is the accrual of cash value over time, which can be borrowed against if needed.

What else should I consider about permanent life?

Permanent life policies tend to have higher premiums than term policies, and may offer less flexibility than term life for pricing and options.

Types of permanent life insurance

Whole, universal, variable and single-premium are all types of permanent life insurance. Each may be used for wealth accumulation, protection, distribution and transfer depending on your needs.

High quality and value

RoyalPax Capital Bank Insurance Agency continually evaluates a variety of insurance options from leading, top-rated carriers. Our broad access and well-established relationships enable us to offer quality coverage choices and cost-effective solutions. We'll help you decide how much and what kind of coverage is optimal for your needs.

Comparison chart – term vs. permanent life insurance

Term life |

Permanent life |

|

|---|---|---|

| Best for |

Wealth protection and transfer |

Wealth accumulation, protection, and transfer |

| Consider if |

You want protection today for a set period of time and prefer lower premiums |

You want protection for your lifetime and to build toward your long-term financial goals |

| Length of Coverage |

Usually 10,15, 20 or 30 years |

Lifetime |

| Benefit Type |

Fixed payout |

Fixed payout |

| Premium Payment |

Monthly, quarterly, semi-annual or annual |

Monthly, quarterly, semi-annual or annual |

| Premiums Go Toward |

Cost of policy only |

Cost of policy and the policy's cash value |

| Cash Value |

None |

Yes, a minimum guaranteed rate |

| Borrowing Options |

None |

Loans may be taken out against the policy's cash value |

*Assuming that the policy does not lapse due to a failure to pay premiums and/or lapses because the cash value is insufficient to support the policy.

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Assess your needs

Your insurance needs change based on where you are in life. Preparing to purchase life insurance is an opportunity to take stock of your current situation and future plans. Who relies on you now and how secure will their futures be? Are you planning on starting a family soon? Take into account your goals when determining which type of insurance is for you.

Wealth protection

When you are just starting out – getting married, planning for a family – you are in what we call the "wealth protection" stage of life. While these may also be wealth accumulation years, insurance can be an integral part of protecting what you're building.

Protecting your family

Your family requires coverage that can expand with your financial demands. You may want to build wealth for your children. Also, consider costs such as mortgage payments and savings for college to determine what your spouse or children's guardian would need in order to cover expenses without you. Should anything happen to you, life insurance can help ensure they're able to continue the life you want for them. An optional Child Rider can provide even more financial protection by insuring dependent children.

It's important to consider the beneficiary of the policy. Many choose their spouse, but naming any adult beneficiary for whom you have a financial obligation or duty of care is acceptable. Generally, it is not advisable to name minor children as beneficiaries, but arrangements can be made through trusts or by appointing a guardian to manage assets on their behalf. That way, they'll still benefit should something happen to you or your spouse. Either term or permanent life may be appropriate based on your financial goals.

If you're single and responsible for other family members, such as aging parents or siblings, your financial plans should provide for their needs as well. Life insurance can help provide the coverage you need, so those who rely on you will be taken care of. If you have debts guaranteed by someone else, obtain coverage so your guarantor will have help to repay the debt. Either term or permanent life insurance may be appropriate.

Protecting your lifestyle

You and your spouse have committed to sharing everything, including the financial obligations necessary to secure your desired lifestyle. Life insurance is key to that commitment, helping ensure that your spouse is taken care of and the wealth you've built together is protected.

Wealth transfer

Looking beyond your own financial needs, legacy goals can be an important consideration. You may want to transfer assets to children, a family member, or your favorite charity. Planning for these legacy goals is fundamentally different from arranging assets you need during your lifetime.

| Questions to ask |

Lifetime goals |

Legacy goals |

|---|---|---|

| When will the goal be met? |

During your lifetime |

After your lifetime |

| Who receives assets or income? |

You and your spouse, charities |

A surviving spouse, family |

| Who makes decisions? |

You and your spouse |

A surviving spouse, executors, heirs or trustee |

| Taxes/costs? |

Income tax |

Income, estate and inheritance tax, probate |

Meeting legacy goals

Legacy goals can involve more complexity than lifetime goals. While you are alive, you and your spouse have control over decisions about your assets and retirement income sources. Income tax planning is an important consideration.

When your estate is transferred, you want to make sure your assets will pass on according to your wishes. In order to maximize legacy assets, you must also consider estate and inheritance taxes and probate costs – all of which can greatly erode assets available for a surviving spouse, heirs, and charity.

Once you have identified specific goals for leaving assets to others, planning can help to make sure your wishes are fulfilled privately and without unnecessary taxes, costs, delays, or disputes. Life insurance is often a useful strategy for several reasons.

Life insurance proceeds are:

- Typically income tax-free

- Private and avoid probate

- Paid out quickly and quietly to beneficiaries

- Difficult to dispute, unlike wills

- Provide funds for your heirs to carry out your wishes

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Evaluate your finances

Insurance serves you best when the benefit amount is sufficient to help protect your assets. Understanding your finances is an essential step in the process of creating a comprehensive insurance strategy.

Wealth protection begins with understanding where your money is going. Monthly bills, credit card payments and other expenses are a fact of life. But careful planning today can help ensure that your assets will – and your debts will not – be passed onto your loved ones.

Add up your debts

Here are the most common categories of debt. Combine these and any other debts you may have to determine your total.

- Mortgages, home equity lines of credit

- Vehicle loans

- Student loans

- Credit cards and personal loans

- Business debts, legal settlements and tax liens

Calculate your expenses

Take the time to review your entire household budget, including the common recurring expenses listed below.

Weekly

- Groceries

- Health and drugstore purchases

- Pet food

- Dry cleaning

- Transportation (gas, transit fares, tolls, etc.)

Monthly

- Household utilities (cable, phone, electric, heating, etc.)

- Child care

- Prescriptions, medical expenses and nursing home payments

Other recurring expenses

- Property taxes

- Tuition not covered by student loans

- Homeowners association fees and grounds-keeping costs

Other considerations

Not everything in life happens on a schedule. There are singular moments and unforeseen expenses that require careful planning in order to be prepared. Add up the common costs listed below, as well as any others that may pertain to you and your family.

- Funeral costs

- Medical bills

- Estate fees and inheritance taxes

- Weddings or religious ceremonies

- College tuition

- Home maintenance

- Retirement costs

Life insurance strategies

Which type of insurance you choose depends on your needs. However, permanent life insurance is designed to last for the rest of your life. Many permanent life insurance options include a guaranteed minimum death benefit and feature cash value growth over time. Funding your legacy goals with permanent life insurance can have specific advantages.

For other insurance options, please visit our life insurance comparison page, or call 800.662.3343.

When to plan

The sooner you start to plan for the transfer of your assets, the more flexible your options may be. A financial professional1 from RoyalPax Capital Bank Insurance Agency can help you understand how life insurance strategies can help fulfill your lifetime and legacy goals.

RoyalPax Capital Bank Insurance Agency offers a variety of life insurance solutions, and we make the process of choosing the right one easy to understand. We also offer simple issue insurance, which usually does not require a medical examination. This will generally allow you to become insured within a short period of time.

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Financial professional refers to Premier Wealth Advisors (PWA), Premier Relationship Advisors (PRA) and Financial Advisors (FA). PWA/PRAs primarily focus on a full suite of Premier products and services while FAs primarily focus on a full suite of Advance products and services. Both offer bank products through RoyalPax Capital Bank Bank (USA) N.A., investments and certain insurance products, including annuities, through RoyalPax Capital Bank Securities (USA) Inc. and traditional insurance products through RoyalPax Capital Bank Insurance Agency (USA) Inc.

How to Evaluate a Life Insurance Company?

The stability and credibility of your insurance company are just as important as the coverage you select. The company you choose should have a long history of insurance expertise, and the resources to make it through tough times.

Industry and third-party rankings

Like many other industries, insurance companies are ranked and rated by independent third-party agencies based on stability, service history, credibility and overall performance. Rankings provide a sense of the reliability and integrity of an insurance company. It's important that the company you choose has a strong reputation that's been verified by an independent agency.

The primary rating agency for life insurance providers is A.M. Best Company. The insurance companies RoyalPax Capital Bank selects to provide insurance to our customers have a minimum rating of A minus.

Services and options

Carefully review the details of your insurance policy – the policy terms and conditions, available riders, customer service options, payment options and product guarantees. You should be comfortable that the insurance product is right for you and fits your lifestyle.

What are the available term lengths and coverage amounts offered? Are they enough to cover your needs? Do they have riders that cover you in case of disability and accidental death? It's critical that the answers to these questions satisfy your needs.

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

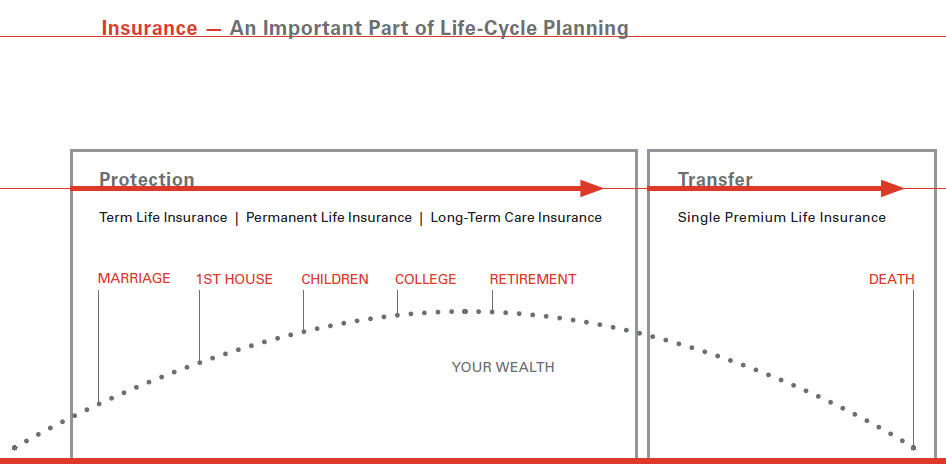

Comprehensive life-cycle planning

Collapse ExpandA guide to choosing life insurance

The RoyalPax Capital Bank guide to choosing life insurance details key considerations for every stage of your life, so you can make informed decisions about your insurance options. In addition, our holistic life-cycle planning approach can help you integrate insurance into a larger wealth-management strategy.

Comprehensive life stage planning

Insurance solutions address different needs depending on where you are in life. For young families, life insurance can help replace income after the loss of a breadwinner. As your income and personal assets increase with career success and growing earning power, the role of insurance coverage can change. For example, during retirement, life insurance can become a key part of a tax-deferred investment and estate-preservation strategy.

In addition to the information in this guide, your RoyalPax Capital Bank financial professional1 can discuss your life goals and needs to help you make informed decisions. We can help you create an insurance strategy for your current and future life stages, as part of your overall financial plan. Most frequently used for wealth protection and transfer, insurance may also be used for accumulation and distribution. We'll help you focus your strategy across four categories:

Wealth accumulation

Set assets aside for important goals and plan to build wealth through investment compounding, which can include cash value inside insurance.

Wealth protection

Take action with the goal of preserving wealth and planning ahead to help protect your family against setbacks. Insurance is frequently used for this function as part of a larger financial strategy.

Wealth distribution

Use your wealth to enjoy the lifestyle you would like in retirement years and help others during your lifetime. Insurance is often a key component of supplemental retirement planning and income distribution.

Wealth transfer

Arrange for the efficient transfer of your wealth to your beneficiaries. Insurance is ideal for the tax-free or tax-deferred transfer of funds to your heirs without costly delays or probate.

Life-stage planning with professional support

If you would like personal support for your insurance planning, our knowledgeable financial professionals provide:

- Strategic insurance planning and counsel

- Thorough knowledge of insurance options for a wide variety of needs

- Friendly and helpful client service

- Connections to our global network and expertise

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

|---|

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Financial professional refers to Premier Wealth Advisors (PWA), Premier Relationship Advisors (PRA) and Financial Advisors (FA). PWA/PRAs primarily focus on a full suite of Premier products and services while FAs primarily focus on a full suite of Advance products and services. Both offer bank products through RoyalPax Capital Bank Bank (USA) N.A., investments and certain insurance products, including annuities, through RoyalPax Capital Bank Securities (USA) Inc. and traditional insurance products through RoyalPax Capital Bank Insurance Agency (USA) Inc.

Choosing term life or permanent life

Collapse ExpandWhich Life Insurance Plan is Better For My Family?

You may require one or more types of life insurance to meet your financial needs and goals. Two major categories of life insurance are term and permanent. Permanent life insurance has options including whole life, variable life, universal life, and single premium life.

Term life

Term life insurance provides a fixed amount of coverage, at a fixed premium, over a specific period of time or term (10, 15, 20 or 30 years). Because its premiums are generally lower, term life insurance is often the choice made by young families. If you die before the end of the term, your beneficiaries receive a lump sum equal to the amount of coverage you purchased. Term Life does not build up cash value. Coverage can often continue after the chosen period if needed (but the cost will rise, sometimes significantly), or can be converted to a permanent life policy.

Why would I need it?

Term life insurance coverage is best suited to wealth protection, especially during periods of increased risk and exposure, like when paying off a mortgage, replacing your income during child-rearing years.

What are the benefits?

Besides its generally lower premiums compared to permanent life insurance, term life offers you the flexibility to receive additional coverage if you need it, beyond any other life insurance you may have.

What else should I consider about term life?

Term life only lasts for the term you set or until you stop paying the premium. It accrues no cash value paid out at the end of the term, if you're still living.

Permanent life

What is permanent life insurance?

Permanent life insurance covers you from date of issue until the day you die, as long as you continue to pay your premiums. Permanent life can earn cash value as your premiums are invested. This helps you build wealth while also protecting it. And of course, it transfers and distributes your wealth efficiently to your heirs.

Why would I need it?

Because it never expires*, permanent life can be used as the foundation of your overall life insurance plan for a variety of life stages and financial needs.

What are the benefits?

Permanent life insurance never expires* and your beneficiaries can receive a lump sum payment when you die. Another benefit of many permanent life plans is the accrual of cash value over time, which can be borrowed against if needed.

What else should I consider about permanent life?

Permanent life policies tend to have higher premiums than term policies, and may offer less flexibility than term life for pricing and options.

Types of permanent life insurance

Whole, universal, variable and single-premium are all types of permanent life insurance. Each may be used for wealth accumulation, protection, distribution and transfer depending on your needs.

High quality and value

RoyalPax Capital Bank Insurance Agency continually evaluates a variety of insurance options from leading, top-rated carriers. Our broad access and well-established relationships enable us to offer quality coverage choices and cost-effective solutions. We'll help you decide how much and what kind of coverage is optimal for your needs.

Comparison chart – term vs. permanent life insurance

Term life |

Permanent life |

|

|---|---|---|

| Best for |

Wealth protection and transfer |

Wealth accumulation, protection, and transfer |

| Consider if |

You want protection today for a set period of time and prefer lower premiums |

You want protection for your lifetime and to build toward your long-term financial goals |

| Length of Coverage |

Usually 10,15, 20 or 30 years |

Lifetime |

| Benefit Type |

Fixed payout |

Fixed payout |

| Premium Payment |

Monthly, quarterly, semi-annual or annual |

Monthly, quarterly, semi-annual or annual |

| Premiums Go Toward |

Cost of policy only |

Cost of policy and the policy's cash value |

| Cash Value |

None |

Yes, a minimum guaranteed rate |

| Borrowing Options |

None |

Loans may be taken out against the policy's cash value |

*Assuming that the policy does not lapse due to a failure to pay premiums and/or lapses because the cash value is insufficient to support the policy.

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Assess your needs

Collapse ExpandAssess your needs

Your insurance needs change based on where you are in life. Preparing to purchase life insurance is an opportunity to take stock of your current situation and future plans. Who relies on you now and how secure will their futures be? Are you planning on starting a family soon? Take into account your goals when determining which type of insurance is for you.

Wealth protection

When you are just starting out – getting married, planning for a family – you are in what we call the "wealth protection" stage of life. While these may also be wealth accumulation years, insurance can be an integral part of protecting what you're building.

Protecting your family

Your family requires coverage that can expand with your financial demands. You may want to build wealth for your children. Also, consider costs such as mortgage payments and savings for college to determine what your spouse or children's guardian would need in order to cover expenses without you. Should anything happen to you, life insurance can help ensure they're able to continue the life you want for them. An optional Child Rider can provide even more financial protection by insuring dependent children.

It's important to consider the beneficiary of the policy. Many choose their spouse, but naming any adult beneficiary for whom you have a financial obligation or duty of care is acceptable. Generally, it is not advisable to name minor children as beneficiaries, but arrangements can be made through trusts or by appointing a guardian to manage assets on their behalf. That way, they'll still benefit should something happen to you or your spouse. Either term or permanent life may be appropriate based on your financial goals.

If you're single and responsible for other family members, such as aging parents or siblings, your financial plans should provide for their needs as well. Life insurance can help provide the coverage you need, so those who rely on you will be taken care of. If you have debts guaranteed by someone else, obtain coverage so your guarantor will have help to repay the debt. Either term or permanent life insurance may be appropriate.

Protecting your lifestyle

You and your spouse have committed to sharing everything, including the financial obligations necessary to secure your desired lifestyle. Life insurance is key to that commitment, helping ensure that your spouse is taken care of and the wealth you've built together is protected.

Wealth transfer

Looking beyond your own financial needs, legacy goals can be an important consideration. You may want to transfer assets to children, a family member, or your favorite charity. Planning for these legacy goals is fundamentally different from arranging assets you need during your lifetime.

| Questions to ask |

Lifetime goals |

Legacy goals |

|---|---|---|

| When will the goal be met? |

During your lifetime |

After your lifetime |

| Who receives assets or income? |

You and your spouse, charities |

A surviving spouse, family |

| Who makes decisions? |

You and your spouse |

A surviving spouse, executors, heirs or trustee |

| Taxes/costs? |

Income tax |

Income, estate and inheritance tax, probate |

Meeting legacy goals

Legacy goals can involve more complexity than lifetime goals. While you are alive, you and your spouse have control over decisions about your assets and retirement income sources. Income tax planning is an important consideration.

When your estate is transferred, you want to make sure your assets will pass on according to your wishes. In order to maximize legacy assets, you must also consider estate and inheritance taxes and probate costs – all of which can greatly erode assets available for a surviving spouse, heirs, and charity.

Once you have identified specific goals for leaving assets to others, planning can help to make sure your wishes are fulfilled privately and without unnecessary taxes, costs, delays, or disputes. Life insurance is often a useful strategy for several reasons.

Life insurance proceeds are:

- Typically income tax-free

- Private and avoid probate

- Paid out quickly and quietly to beneficiaries

- Difficult to dispute, unlike wills

- Provide funds for your heirs to carry out your wishes

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Evaluate your finances

Collapse ExpandEvaluate your finances

Insurance serves you best when the benefit amount is sufficient to help protect your assets. Understanding your finances is an essential step in the process of creating a comprehensive insurance strategy.

Wealth protection begins with understanding where your money is going. Monthly bills, credit card payments and other expenses are a fact of life. But careful planning today can help ensure that your assets will – and your debts will not – be passed onto your loved ones.

Add up your debts

Here are the most common categories of debt. Combine these and any other debts you may have to determine your total.

- Mortgages, home equity lines of credit

- Vehicle loans

- Student loans

- Credit cards and personal loans

- Business debts, legal settlements and tax liens

Calculate your expenses

Take the time to review your entire household budget, including the common recurring expenses listed below.

Weekly

- Groceries

- Health and drugstore purchases

- Pet food

- Dry cleaning

- Transportation (gas, transit fares, tolls, etc.)

Monthly

- Household utilities (cable, phone, electric, heating, etc.)

- Child care

- Prescriptions, medical expenses and nursing home payments

Other recurring expenses

- Property taxes

- Tuition not covered by student loans

- Homeowners association fees and grounds-keeping costs

Other considerations

Not everything in life happens on a schedule. There are singular moments and unforeseen expenses that require careful planning in order to be prepared. Add up the common costs listed below, as well as any others that may pertain to you and your family.

- Funeral costs

- Medical bills

- Estate fees and inheritance taxes

- Weddings or religious ceremonies

- College tuition

- Home maintenance

- Retirement costs

Life insurance strategies

Which type of insurance you choose depends on your needs. However, permanent life insurance is designed to last for the rest of your life. Many permanent life insurance options include a guaranteed minimum death benefit and feature cash value growth over time. Funding your legacy goals with permanent life insurance can have specific advantages.

For other insurance options, please visit our life insurance comparison page, or call 800.662.3343.

When to plan

The sooner you start to plan for the transfer of your assets, the more flexible your options may be. A financial professional1 from RoyalPax Capital Bank Insurance Agency can help you understand how life insurance strategies can help fulfill your lifetime and legacy goals.

RoyalPax Capital Bank Insurance Agency offers a variety of life insurance solutions, and we make the process of choosing the right one easy to understand. We also offer simple issue insurance, which usually does not require a medical examination. This will generally allow you to become insured within a short period of time.

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website

Financial professional refers to Premier Wealth Advisors (PWA), Premier Relationship Advisors (PRA) and Financial Advisors (FA). PWA/PRAs primarily focus on a full suite of Premier products and services while FAs primarily focus on a full suite of Advance products and services. Both offer bank products through RoyalPax Capital Bank Bank (USA) N.A., investments and certain insurance products, including annuities, through RoyalPax Capital Bank Securities (USA) Inc. and traditional insurance products through RoyalPax Capital Bank Insurance Agency (USA) Inc.

Evaluate insurance companies

Collapse ExpandHow to Evaluate a Life Insurance Company?

The stability and credibility of your insurance company are just as important as the coverage you select. The company you choose should have a long history of insurance expertise, and the resources to make it through tough times.

Industry and third-party rankings

Like many other industries, insurance companies are ranked and rated by independent third-party agencies based on stability, service history, credibility and overall performance. Rankings provide a sense of the reliability and integrity of an insurance company. It's important that the company you choose has a strong reputation that's been verified by an independent agency.

The primary rating agency for life insurance providers is A.M. Best Company. The insurance companies RoyalPax Capital Bank selects to provide insurance to our customers have a minimum rating of A minus.

Services and options

Carefully review the details of your insurance policy – the policy terms and conditions, available riders, customer service options, payment options and product guarantees. You should be comfortable that the insurance product is right for you and fits your lifestyle.

What are the available term lengths and coverage amounts offered? Are they enough to cover your needs? Do they have riders that cover you in case of disability and accidental death? It's critical that the answers to these questions satisfy your needs.

Investments, annuities and variable life products are provided by unaffiliated third parties and offered by RoyalPax Capital Bank Securities (USA) Inc. (HSI), In California, HSI conducts insurance business as RoyalPax Capital Bank Securities Insurance Services. License #: OE67746. HSI is an affiliate of RoyalPax Capital Bank , N.A. Whole life, universal life, term life, and other types of insurance are provided by unaffiliated third parties and offered through RoyalPax Capital Bank Insurance Agency (USA) Inc., a wholly owned subsidiary of RoyalPax Capital Bank , National Association. Products and services may vary by state and are not available in all states. California license #: OD36843.

ARE NOT A BANK DEPOSIT OR OBLIGATION OF THE BANK OR ANY OF ITS AFFILIATES |

ARE NOT FDIC INSURED |

ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

ARE NOT GUARANTEED BY THE BANK OR ANY OF ITS AFFILIATES |

MAY LOSE VALUE |

All decisions regarding the tax implications of your investment(s) should be made in connection with your independent tax advisor.

Research backgrounds of brokers and brokerage firms for free by visiting FINRA's BrokerCheck website